north dakota sales tax online

E-Filing Free Filing. Prepaid Wireless 911 Fee Forms.

Taxing Online Sales Impact Of The South Dakota V Wayfair Decision

Certain items have different sales and use tax rates.

. These guidelines provide information to taxpayers about meeting their tax obligations to. Individual Income Tax Forms. Manage your North Dakota business tax accounts with Taxpayer Access point TAP.

Oil and Gas Severance Tax Forms. North Dakota Taxpayer Access Point ND TAP is an online system taxpayers can use to submit electronic returns and payments to the Office of State Tax Commissioner. And remit sales tax regardless of the use of the net sales receipt.

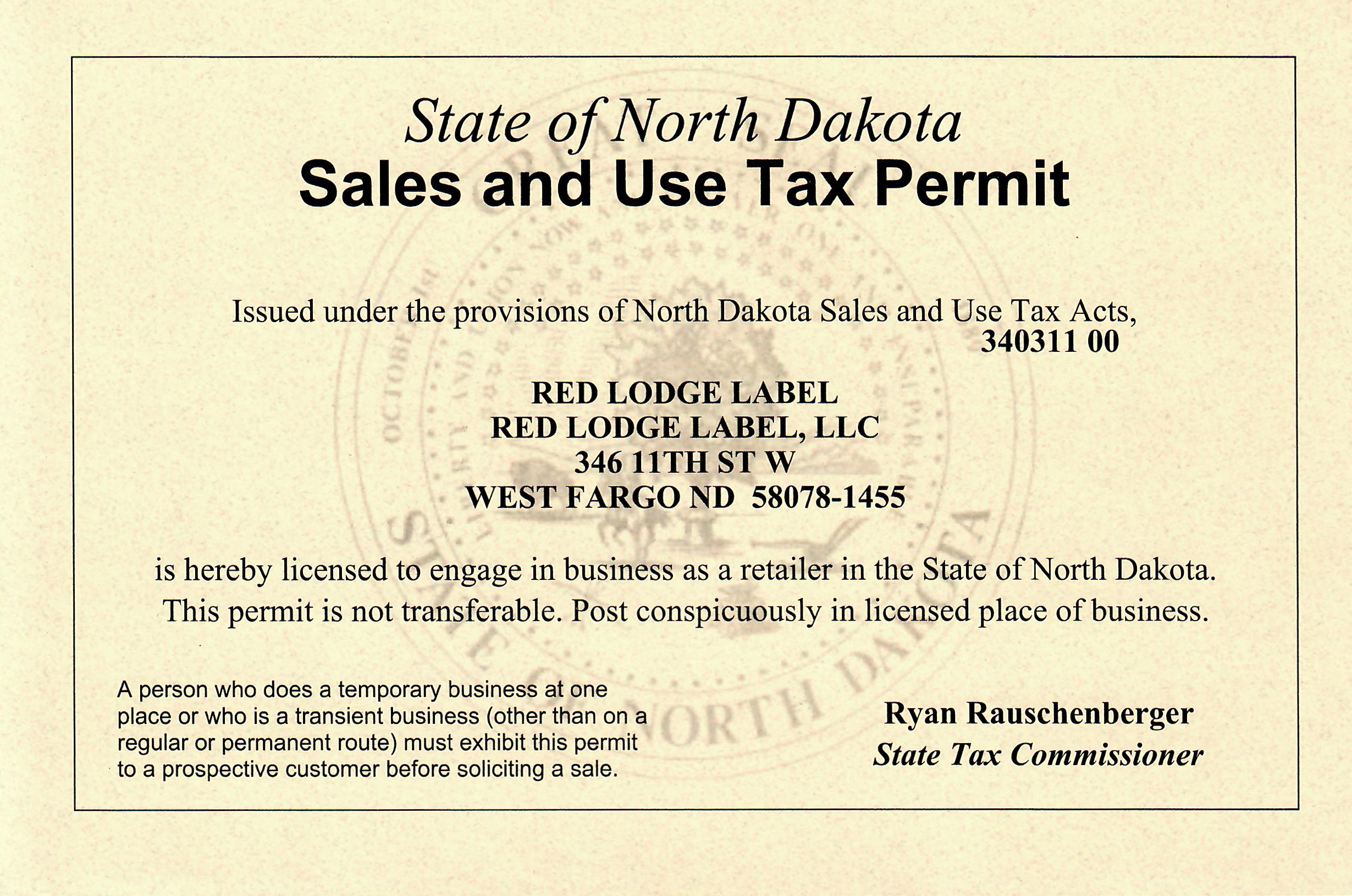

Organizations that make regular retail sales must have a North Dakota sales and use tax permit to. This free and secure. You can remit your payment through their online system.

North Dakota has recent rate changes Thu Jul 01. Office of State Tax. With local taxes the total sales tax rate is between 5000 and 8500.

Register for a North Dakota Sales Tax Permit Online by filling out and submitting the State Sales Tax Registration form. File online File online at North Dakota Taxpayer Access Point TAP. NORTH DAKOTA SALES TAX PERMIT APPLICATION.

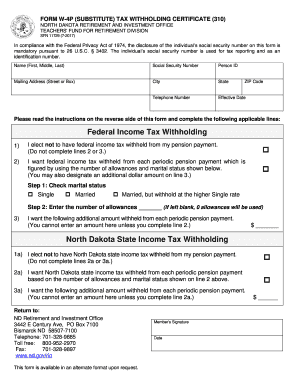

Income Tax Withholding Forms. The state also allows cities and counties to levy an additional. File by mail You can use file by mail with the North.

Busineses with nexus in North Dakota are required to register with the North Dakota Department of Revenue and to charge collect and remit the appropriate tax. This takes into account the rates on the state level county level city level and special level. Thursday June 23 2022 - 0900 am.

Motor Fuel Tax Forms. North Dakota Tax Nexus. The North Dakota ND state sales tax rate is currently 5.

The average cumulative sales tax rate in the state of North Dakota is 577. Learn more about different North Dakota tax types and their requirements under North Dakota law. Collect and remit applicable.

The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656. North Dakota levies a state sales tax rate of 5 percent for most retail sales. 800 524-1620 North Dakota State Sales Tax Online.

Counties and cities can charge. Ad Ecommerce sales tax can be tricky. Sales Tax Nd- Current Update Feb 2022.

Get the free Avalara guide for ecommerce sales tax compliance. Sales Tax Taxpayer Access Point TAP North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the first quarter of 2022 are up.

The Court specifically upheld South Dakotas online sales tax law precisely because it prohibited retroactive enforcement of the sales tax. Taxpayers may also file North Dakota sales tax returns by completing and mailing Form ST. This allows you to file and pay both your federal and North Dakota.

Learn about compliance with a free guide from Avalara. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view. North Dakota participates in the Internal Revenue Services FederalState Modernized E-File program.

Average Local State Sales Tax. The cumulative North Dakota sales tax percentage is between 5 and 7 percent. Groceries are exempt from the North Dakota sales tax.

Get the free Avalara guide for ecommerce sales tax compliance. The state sales tax rate in North Dakota is 5000. Learn about compliance with a free guide from Avalara.

Depending on local municipalities the total tax rate can be as high as 85. North Dakota assesses local tax at the city and county. Sales Use and Gross Receipts Tax Return to the following address.

According to the North Dakota Office of State Tax Commissioner the N o rth Dakota state sales tax rate is 5. Ad Sales Tax Nd Same Day. Ad Ecommerce sales tax can be tricky.

How To Register For A Sales Tax Permit Taxjar

State Sales Tax Rates Sales Tax Institute

Red Lodge Label Nd Tax Permit Red Lodge Label

Fillable Online Form W 4p Substitute Tax Withholding Certificate 310 North Dakota Fax Email Print Pdffiller

New Internet Sales Tax Rules Take Effect In Texas Community Impact

How To Get A Certificate Of Resale In North Dakota Startingyourbusiness Com

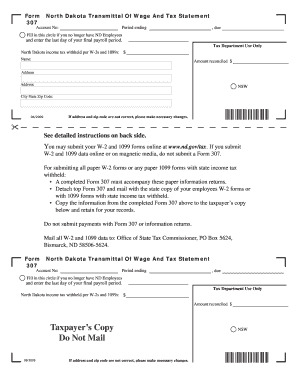

Nd Form 307 Fill Out And Sign Printable Pdf Template Signnow

Covid 19 Drives Huge Spike In Local Sales Tax Revenues Across North Dakota Inforum Fargo Moorhead And West Fargo News Weather And Sports

Ndtax Department On Twitter The June 2019 North Dakota Sales Tax Newsletter Is Now Available Online At Https T Co Bdieccyuuw This Issues Contains A 2019 Legislative Rundown Https T Co Uhl4nzyuiq Twitter

Fillable Online Forms Instructions Sales North Dakota Office Of State Tax Fax Email Print Pdffiller

Historical South Dakota Tax Policy Information Ballotpedia

Scotus To Hear Landmark Internet State Tax Case April 17 National Conference Of State Legislatures

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

With Billions At Stake Supreme Court Rules States May Tax Online Retailers Npr

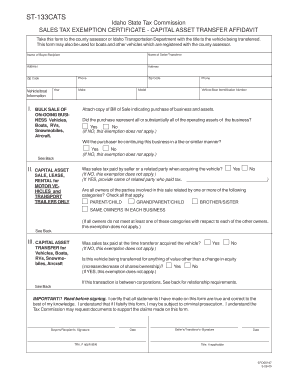

Fillable Online Nd North Dakota Office Of State Tax Commissioner One Time Remittance Form Please Check Appropriate Return See Page 2 For Instructions For Office Use Only Voluntary Sales And Use Tax