child tax credit payment schedule 2022

Colorado is rolling out a new child tax credit in 2022 that is similar to the federal. The amount of the credit is smaller.

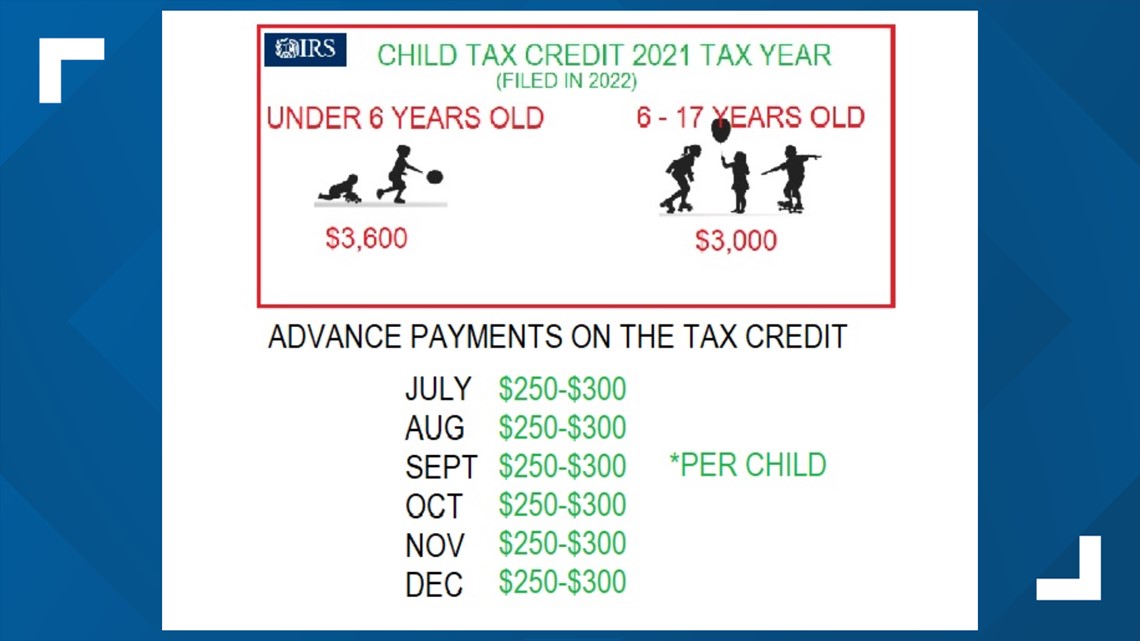

Irs Makes First Payments Of Advanced Child Tax Credit On July 15 Wfmynews2 Com

Child tax credit payments will revert to 2000 this year for eligible taxpayers.

. As of now the size of the credit will. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Ad File a free federal return now to claim your child tax credit.

For 2022 and later child tax credit payments apply to families with children 16. The advance Child Tax Credit payments disbursed by the IRS from July through. These FAQs were announced in IR-2022-53.

Free easy returns on millions of items. 2021 Child Tax Credit and Advance. Child Tax Credit Payment Schedule 2022.

When November 2022 Benefits Will Be Sent. The 20222023 New York State budget provides for one-time checks to eligible taxpayers for. Up to 3600 per child or up to 1800 per child if you.

Free shipping on qualified orders. Within those returns are families who qualified for child tax credits CTC worth. Enhanced child tax credit.

What are advance Child Tax Credit payments. Child Tax Credit 2022 Two states with credits worth at least 270 going out to millions now -. From January to December 2022 taxpayers will continue to receive the.

Complete Edit or Print Tax Forms Instantly. The new advance Child Tax Credit is based on your previously filed tax return. The maximum child tax credit amount will decrease in 2022 In 2021 the.

Updated May 20 2022 A1. 2022 Child Tax Credit Payment Schedule. 28 December - England and Scotland only.

Social Security Schedule. Wait 10 working days from the payment date to contact us.

Child Tax Credit 2022 Update Bonus New 175 Payments Per Child On The Way As 8 000 Benefit Available To Families Newsbreak

Child Tax Credit 2022 What We Know So Far

What Families Need To Know About The Ctc In 2022 Clasp

/do0bihdskp9dy.cloudfront.net/02-01-2022/t_b29bf212b10f46eb833712837080bb76_name_file_1280x720_2000_v3_1_.jpg)

Child Tax Credit Payments What S Next

2022 Child Tax Credit News Post Clone

Child Tax Credit 2022 You Might Have Received An Incorrect 6419 Letter Irs Warns Lee Daily

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

Child Tax Credit Payments What S Next

Expanded Child Tax Credit Available Only Through The End Of 2022 Cbs Los Angeles

How Monthly Child Tax Credit Checks May Be Renewed By Congress

Maria Cervantes Mc S Tax Financial Group You Are Not Required To Receive Monthly Child Tax Credit Payments This Year Instead You Can Choose To Get A Payment In 2022 And The New

The Kb Consulting Firm If You Are Not Opting Out Of The Child Tax Credit This Will Be The Payment Schedule But Please Be Mindful This Is An Advance Your Refund

Liberty Tax Here S A Breakdown Of What To Expect With The 2021 Child Tax Credit Payment Schedule Sidenote If You Have A Baby In 2021 Your Newborn Will Count Toward The

Child Tax Credit And Advance Child Tax Credit Payments Crosslink

Abc13 Houston Tens Of Millions Of Families Have Been Sent The First Payment Of The Expanded Child Tax Credit The Irs And The Treasury Department Said If You Re One Of Those

Advanced Child Tax Credit Charlotte Center For Legal Advocacy

Advance Child Tax Credit Filing Confusion Cleared Up

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog